These 3 Questions Will Save You From Investment Heartbreak!

Remember CBEX? 😭 Oh yes, nothing hurts more than working hard, saving money, then losing it to the wrong investment...

You know that sinking feeling when your money's due back and all you get are Italian stories?

Let's make sure that never happens to you again.

Before we dive in, here's what I know: most people focus on returns first. Big mistake. The real question isn't "how much will I make?" but "will I get my money back at all?"

That's what Beat The Odds is about! Giving you the framework to make smart financial decisions that actually protect and grow your wealth, not just chase shiny returns.

Secure your spot here before spots get filled up.

Here are the 3 questions I ask before putting money into any fixed income investment:

Question 1: Who Am I Lending This Money To?

When you invest in fixed income, you're essentially giving someone a loan. So the creditworthiness and capacity of who you're lending to is everything.

The spectrum looks like this:

Government (safest—they can print money)

Banks (your fixed deposits)

Blue chip companies

Medium-scale companies

Mom-and-pop shops

Loan sharks (highest risk)

Key insight: Government bonds in foreign currency carry more risk than local currency bonds. When the government borrows in dollars but earns in naira, that's a different conversation entirely.

Even that popular agric investment? You're lending money to an agric company. If storms wipe out crops, can they still pay you back? That's what matters.

Question 2: How Long Is My Money Locked Away?

This is where people mess up. They see a high yield and jump in, only to realize their money is locked for 7 years when they need it in 6 months.

The terminology:

Less than 1 year = Treasury bills (government) or Commercial paper (companies)

More than 1 year = Treasury bonds (government) or Corporate bonds (companies)

Ask yourself: Does this timeline work with my financial plans? Because you can't just change your mind halfway through.

Question 3: Is The Return Worth The Risk?

Notice this comes last, not first.

If the government offers 5% on Treasury bills and a blue chip company offers 7% on commercial paper, but a loan shark offers 6%—that makes no sense. Higher risk should mean higher returns.

Remember: If your capital doesn't come back, the return rate is meaningless.

The Bottom Line

Every fixed income investment should pass all three tests:

Can they pay me back?

Can I afford to be without this money for this long?

Does the return match the risk?

Still Overwhelmed by Investment Decisions?

Here's the truth: you can read about investing strategies all day, but without a clear system that fits your financial situation, you'll keep making emotional decisions that hurt your wealth.

You've worked hard for your money. You deserve better than Italian stories when it's time to collect.

Beat The Odds is happening next Saturday, June 28th, 2025. This isn't just theory—it's a practical system for making financial decisions that actually protect and grow your wealth.

Because the difference between those who build lasting wealth and those who don't isn't luck. It's having the right framework.

Here it yourself from a past attendee.

Few spots left! Join us on June 28th. Your money deserves better.

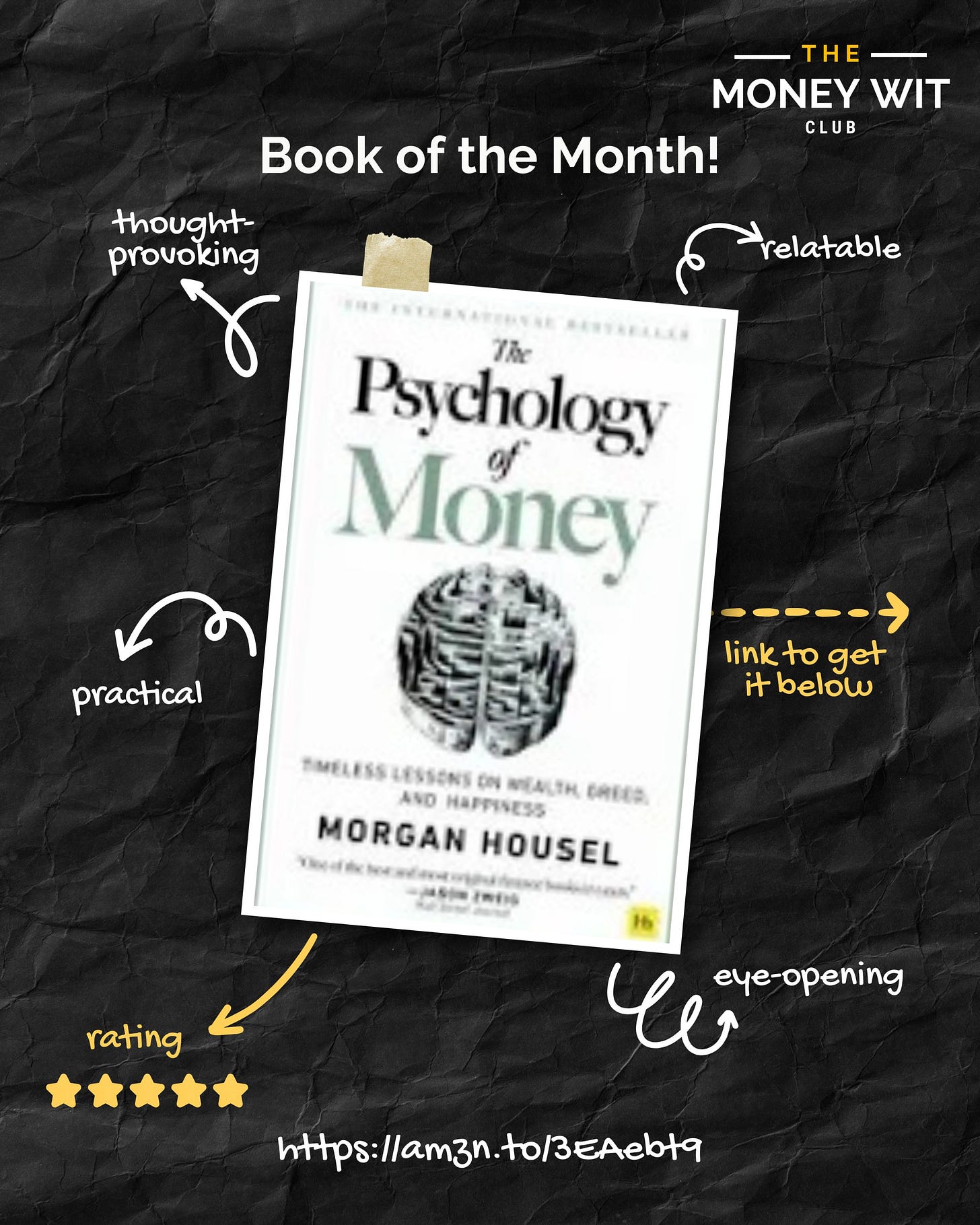

This Week's Nugget: The Psychology of Risk

Housel writes: "Risk is what's left over after you think you've thought of everything."

We often focus so much on the upside that we ignore what could go wrong. But the best investors aren't the ones who never face risks. They're the ones who only take risks they can afford to lose.

"The ability to do what you want, when you want, for as long as you want, has an infinite ROI."

Before your next investment, ask: What's the worst that could happen, and can I live with that outcome?

Get the Book Here and let’s discuss!

Help Us Help You Better

What's your biggest fear when it comes to investing?

Losing your principal? Not knowing who to trust? Being locked in too long? Tell us in this quick survey so we can address your real concern.

Takes 2 minutes. Could save you thousands.

Inside The Club

This month, for our monthly webinar, we’re having an AMA Money session with Oler herself.

Whether you’re just starting out as an investor or figuring out how to diversify, this is your chance to ask and learn in real time. (Of course, if you’re a member of the club.)

If not, you can click here to join waitlist the community.

Ongoing club deals

<We have a new YouTube video on our channel that breaks down Smart Ways to Manage Money As A Couple! Watch, learn, and share with a friend.

Did you enjoy reading this? Help spread the message by forwarding to at least 10 of your contacts.

Was this email forwarded to you? Subscribe here.

We host weekly money discussions live on our YT channel… visit our channel

Want to advertise with us? Email business@oleroladele.com

At the Money Wit Club, we provide you with opportunities to invest in high-value companies with the potential to help you yield the highest returns on your investments. Watch full interview here.

Join the Money Wit Club today.

Until next week,

Oler.