The 2 Investment Questions That Will Save You From Losing Your Money!

The roadmap to making smart investment decisions when everything feels like a blur!

If you've saved money but don't know where to start with investing, you're not alone.

I get this question constantly—everything seems overwhelming, and you're not sure where to begin.

But before we dive in, remember that knowing what to invest in isn't enough. The real question is, how do you fit it into your life right now? That's where most people get stuck, even high earners.

That's what Beat The Odds is about: a transformative finance and investment workshop built to help you put your finances in order, protect your money from inflation, and build sustainable wealth in uncertain times.

Here's your clarity. Secure your spot here

What is investment, really?

Investing is putting your money into some form of venture with the expectation that it will come back to you with additional return. That expectation of return is what makes it an investment.

If you give someone money without expecting it back, it's a gift. If you expect it back but without any return, you're just helping someone—not investing.

The first question: Why do you want to invest?

Yes, we all want our money to work for us. But what are you trying to achieve specifically?

Defining your investment goals is key. As Muhammad Ali said, "My hands can't hit what my eyes can't see."

If you haven't defined what you're trying to achieve, it's unlikely you'll achieve it.

Two basic forms of Investing:

Debt Instruments: You provide capital for a specific period and get your cash back at maturity with interest. Think fixed deposits, Treasury bills, or anything with a commitment to pay you back after six months, one year, etc.

Equity Investments: You hold an ownership stake. There's no official date when your cash comes back to you. Your only exit is selling your stake to someone else.

The key questions to ask:

For debt investments: Is this person/entity able to pay me back? Do they have cash flows to accommodate every payment?

For equity investments: Will the value of this investment go up? Since you can only exit by selling to someone else, growth potential is everything.

How do you decide which works for YOU?

Your holding period matters. Equity investments require you to stay longer, but the risk is higher. If the company struggles while you're holding, you're stuck. Your ₦100k might become ₦95k, and you have to decide if you can take that loss.

Your goals determine everything. If you need money in three months and the equity market is choppy, it makes sense to choose peace of mind over potentially higher returns.

Where to Start

The good news? Investing has never been easier. You can download apps from asset management companies, fund your account directly, and buy whatever you want. You don't need to visit offices anymore.

Remember: There are two things you should never outsource: your health and your finances. Stay engaged. Don't block your mind to personal finance and economics because it affects everyone.

The bottom line: Define your goals, understand the risks, and match your investment choice to your timeline and risk tolerance.

Still Feeling Stuck?

Here's the reality: you can read about investing all day, but if you don't have a clear, actionable plan that fits your financial situation right now, you'll stay stuck in analysis paralysis.

You're earning well, but your bank balance doesn't reflect it. You've maybe tried investing before and lost money. You want to build wealth, not just survive another month.

Sound familiar?

Beat The Odds is happening on June 28th, 2025. This isn't just another workshop! It's your roadmap to finally putting your finances in order, protecting your money from inflation, and building sustainable wealth even in uncertain times.

Because the difference between those who build wealth and those who don't isn't access to information. It's having a system that works for their life.

Join us on June 28th. Your future self will thank you. Get access here.

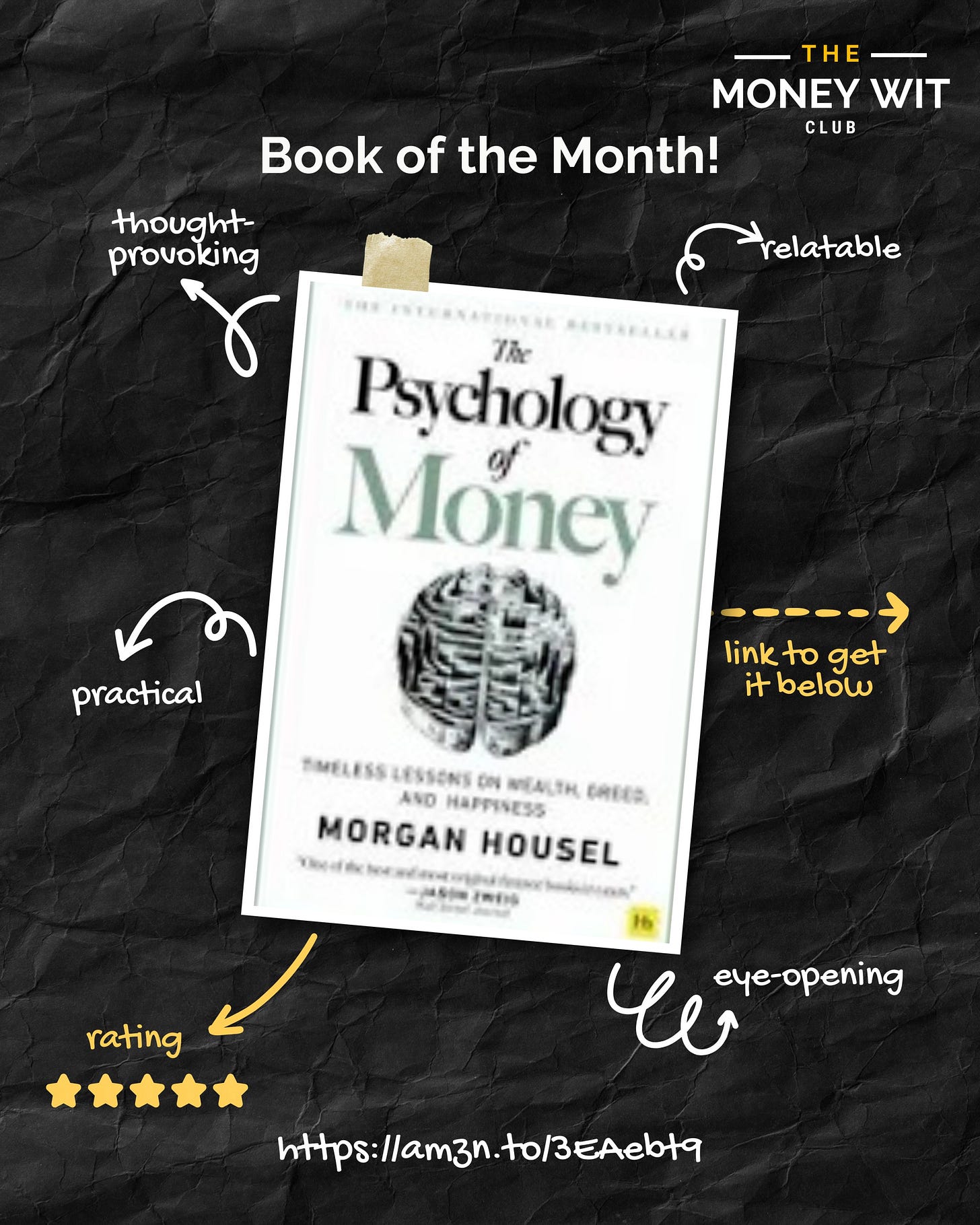

This Week's Nugget: Know What Game You're Playing!

Housel reminds us that every investor is playing a different game, even when they're buying the same assets.

A day trader and a retirement saver might both buy the same stock, but they're playing completely different games with different rules, time horizons, and goals.

The danger? When you start copying someone else's strategy without understanding their game.

"The biggest investing errors come when you adopt the attitudes of a game you're not playing."

So before you invest, ask yourself: What game am I playing? What's my timeline? What are my real goals?

Because the "right" investment choice depends entirely on which game you're actually playing.

Get the Book Here and let’s discuss!

Help Us Help You Better

What's stopping you from making your next investment move?

Is it fear of losing money? Not knowing where to start? Analysis paralysis? Tell us in this quick survey so we can create content that actually moves the needle for you.

Takes 2 minutes. Shapes everything we do next.

Inside The Club

Today, we're hosting a special fireside chat with Wole Shenbanjo (Group CEO, Shenbee Investments!)

Topic: "What I Know Now That I Wish I Knew Earlier"

Wole's built multiple successful companies across travel, finance, and investment over 15+ years. He's sharing the hard-won lessons that could save you years of trial and error. He’ll also be sharing lessons on recovering from failure and finding your way back.

Join the waitlist for the community to access these intimate conversations and connect with other serious wealth builders.

This month, for our monthly webinar, we’re having an AMA Money session with Oler herself.

Whether you’re just starting out as an investor or figuring out how to diversify, this is your chance to ask and learn in real time. (Of course, if you’re a member of the club.)

If not, you can click here to join waitlist the community.

Ongoing club deals

<We have a new YouTube video on our channel that breaks down 7 Great Money Lessons to Teach Your Kids (Before It's Too Late)! Watch, learn, and share with a friend.

Did you enjoy reading this? Help spread the message by forwarding to at least 10 of your contacts.

Was this email forwarded to you? Subscribe here.

We host weekly money discussions live on our YT channel… visit our channel

Want to advertise with us? Email business@oleroladele.com

At the Money Wit Club, we provide you with opportunities to invest in high-value companies with the potential to help you yield the highest returns on your investments. Watch full interview here.

Join the Money Wit Club today.

Until next week,

Oler.