Nigeria imports Danish cows in bid to slash $1.5 billion milk import bill | Global news review

Here is what you need to know about this week's Global news review and how it affects you and your business + a lot of goodies for you!

Nigerian News: Nigeria imports Danish cows in bid to slash $1.5 billion milk import bill

Nigeria is importing dairy cattle from Denmark as it aims to double its milk output within five years, part of a plan to cut dairy imports that cost the country $1.5 billion a year, Livestock Minister Idi Maiha said on Monday.

Our thoughts:

Not much news out of Nigeria apart from The President commissioning various projects in Lagos, so we will spotlight cows! Yes, you read that right.

Nigeria is importing Danish cows — not pastries, not wind turbines, not Lego — cows.

Why? Because we’re tired of spending over $1.5 billion a year importing milk. Our local cows just aren’t pulling their weight (or their milk).

What’s the Scoop?

Nigeria’s government, in partnership with Danish company Arla Foods, has brought in a batch of premium Danish dairy cows to help boost local milk production.

These cows are basically the Beyoncé of bovines — they can produce 25-35 litres of milk a day. Compare that to your average Nigerian cow, which politely offers just 1-2 litres, and you understand why the country said, “Let’s outsource.”

Why Is This Happening?

Because milk is serious business. From pap to coffee to growing bones, we depend on it — yet Nigeria imports over 60% of what it consumes. That’s not great for:

The economy

The Naira

Your wallet

National dairy pride

So, the new strategy: Bring in super-cows, train local farmers, and hopefully reduce import dependency.

Who Benefits?

The Government, if this project reduces that massive milk import bill.

Local Farmers, who’ll learn from Danish dairy experts and upgrade their herds.

Consumers, who might one day pay less for milk (key word: might).

The Naira, which could stop leaking foreign exchange on every tin of imported milk.

Also... cheese lovers may secretly rejoice. Danish cows don’t just give milk — they give quality milk. 👀

Who Might Lose?

Milk Importers, who could face declining demand over time.

Local cows, now being out-milked, outclassed, and possibly out of a job.

Skeptics, who may have to admit that "importing cows" wasn't such a wild idea after all.

What Could Go Wrong?

Climate Shock: Danish cows are used to frosty weather. Nigerian heat might turn them into sunbathing mascots. Hehehe, picture Danish cows in AC’d up farms!

Feed & Infrastructure: These cows eat like royalty and need proper vet care and cooling. That’s not yet widespread in Nigeria.

Moo-nagement issues: Scaling from pilot to full production takes time, skill, and a lot of cow patience.

What Should We Watch For?

Will this reduce milk prices in the next 2–3 years? Maybe not, but it will most likely stem the increase in price.

Are we training enough local farmers to care for these cows long-term?

Will we invest in cold chains and dairy infrastructure to keep the milk from spoiling before it reaches you?

Is there a chance that we will start buying Danish beef in a few eke market days?

Final Thought

Importing cows may sound funny — but it’s actually a bold step in fixing a long-standing problem. Nigeria needs local production to rise, not just in dairy, but in many other sectors where imports have drained our economy dry.

So yes, laugh if you want — but one day soon, your cup of tea might be cheaper because a Danish cow decided to sweat it out in Kaduna.

Global News: Wells Fargo No Longer Faces Federal Reserve’s 2018 Asset Cap

The Federal Reserve has lifted restrictions imposed on Wells Fargo's (WFC) growth seven years ago following a series of scandals, including one where staff set up fake accounts.

Our thoughts:

Wells Fargo Is Finally Free to Grow Again

U.S. Federal Reserve has lifted a major restriction on Wells Fargo — one that had been holding the bank back since 2018.

🧐 What’s the Backstory?

Back in 2016, Wells Fargo got into hot water for opening fake accounts in customers’ names without their permission. As punishment, the Fed stepped in and said, “You can’t grow your bank any bigger than it is now.”

That meant Wells Fargo couldn’t take on more customer deposits or grow its loan business.

For a bank, that’s like being told you can’t open new shops or serve more people.

But after years of cleaning up its act — changing leadership, improving its internal controls, and trying to rebuild trust — Wells Fargo just got the green light to grow again.

With the cap lifted, Wells Fargo can now roll out new products and services. That might mean more loan offers, better interest rates, or more tech upgrades to improve how you bank but with the current uncertainty in the US economy, they may be slow to increase their loan books. Of course, the bank’s stock jumped after the news broke — a sign that investors see this as a good thing.

What Can We Learn?

Actions Have Long-Term Consequences: That 2016 scandal cost Wells Fargo years of growth and a serious hit to its reputation. Trust takes time to rebuild.

Regulators Are Watching: The Fed sent a strong message — banks that misbehave won’t just pay fines; they’ll face real limits.

These are some of the tools the Feds use to enhance depositors confidence in the system. We wish Wells Fargo all the best!

African News: Kenya: Capital Requirement Rule to Trigger Bank Mergers

The Central Bank of Kenya (CBK) plans to lift its 10-year ban on issuing new banking licenses on July 1. This change will open the market to fintechs and digital banks, which is expected to increase market competition and, possibly, bank consolidations as small banks are forced to merge or exit the industry.

Our thoughts:

Kenya is raising the bar — literally.

The Central Bank of Kenya (CBK) wants all commercial banks to have at least KSh10 billion in core capital by the year 2029. That’s up from just KSh1 billion today.

They won’t make banks do it overnight — the new rule will be phased in gradually:

KSh3 billion by 2025

KSh6 billion by 2026

KSh10 billion by 2029

Why? To make sure banks are financially strong and can survive tough times.

✔️ Bigger, Stronger Banks

Larger banks with more capital can handle risks better — like loan defaults or economic shocks. That means less chance of a financial crisis.

✔️ More Mergers Ahead

Not all banks can afford this jump. Smaller banks may need to merge or get acquired. So expect fewer banks in the market — but bigger ones.

✔️ Improved Investor Confidence

Stronger, well-capitalized banks may attract more foreign investment into Kenya, boosting the economy long-term.

But It’s Not All Smooth Sailing

❌ Trouble for Small Banks

About 24 banks may struggle to meet the new targets. These banks often serve rural areas and small businesses. If they disappear, some people could lose easy access to banking.

❌ Possible Job Cuts

The Kenya Bankers Association is warning that nearly 7,000 jobs could be lost due to closures and consolidations.

🧠 Why Is This Important?

This move is a balancing act: build a stronger, more stable banking system without making banking harder to access for everyday Kenyans.

Think of it like renovating a house — things may get a bit messy in the short term, but the goal is a sturdier, safer home in the long run.

🔭 What Should You Expect Next?

More merger announcements

Capital raises- Public offers

Closer attention to which banks are growing — and which are not.

Final Thought

This is one of the biggest banking changes in Kenya in years, like Nigeria that is counting down to 2026 to see which banks will meet the previously announced capital requirement, we’ll watch and see how it all plays out.

Beat The Odds Early bird discount ends today!

Beat The Odds is our personal finance and investment workshop designed to help you:

Put your finances in order

Protect your money from inflation

Build sustainable wealth in uncertain times

Date: 28th June 2025 | Time: 4-7 pm GMT+1

Replay will be available for a month after the session + a discussion forum to get questions answered.

Watch Dr Uzoma's (past attendee) testimonial here.

Join us here!

Are you reading with us?

This week's nugget: Getting Wealthy vs. Staying Wealthy Are Two Different Skills

Housel makes a clear distinction: Getting rich often requires taking risks, being optimistic, and seizing opportunities.

But staying rich? That’s a different game—it takes humility, discipline, and a healthy dose of fear.

He puts it simply: “Good investing is not necessarily about making good decisions.

It’s about consistently not screwing up.” So while ambition might help you build wealth, it’s caution, patience, and consistency that help you keep it.

Ask yourself: Are your money habits helping you gain wealth or preserve it?

Get the Book Here and let’s discuss!

Help Us Shape What’s Next

Your voice matters more than you know.

We’re building this for you, and we want to make it even better with you.

Tell us what’s working. What’s missing? What would make your money journey easier, faster, and richer — literally and figuratively? Fill out the form here.

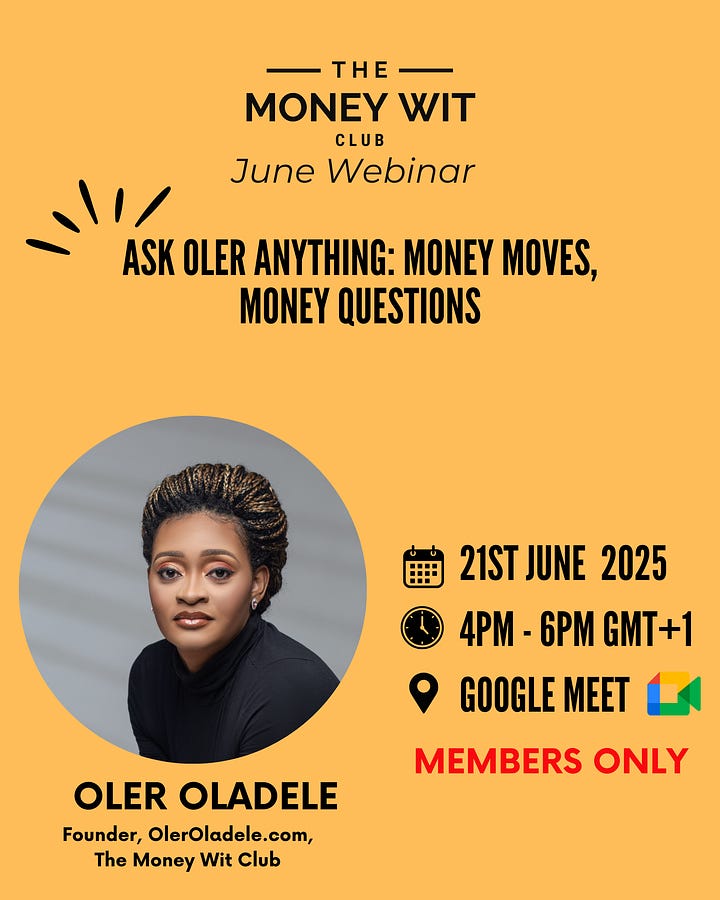

What’s happening at the Money Wit Club….

This month, for our monthly webinar, we’re having an AMA Money session with Oler herself. Whether you’re just starting out as an investor or figuring out how to diversify, this is your chance to ask and learn in real time. (Of course, if you’re a member of the club.)

If not, you can join the waitlist!

And for our first Fireside chat session in June, we’re having a chat with Wole Shenbanjo (Group CEO, Shenbee Investments). He's sharing the hard-won lessons that could save you years of trial and error. He’ll also be sharing lessons on recovering from failure and finding your way back.

To be a part of incredible sessions like this, click here to join waitlist the community.

Ongoing club deals

We discussed this week’s news live on YouTube and what it means for you and your business this morning. Watch the recap above.

Turn on your notifications and join us live at 9 AM every Saturday!

7 Great Money Lessons to Teach Your Kids (Before it’s too late!)

We have a new YouTube video on our channel that breaks down Seven Money Lessons You Should Teach Your Kids! Watch, learn, and share with a friend.

Watch here and don't forget to share with someone who needs to see it.

Did you enjoy reading this? Help spread the message by forwarding to at least 10 of your contacts.

Was this email forwarded to you? Subscribe here.

We host weekly money discussions live on our YT channel… visit our channel

Want to advertise with us? Email business@oleroladele.com

At the Money Wit Club, We provide you with opportunities to invest in high-value companies with potential to help you yield the highest returns on your investments.

Watch full interview here

Click the button below for more information on how to join the club.

Thanks for reading this week’s letter. We love having you here. Got thoughts on today’s edition? Hit reply and let us know! See you next week with more Global news and money wisdom.