I was on Arise TV this week...

On Eurobonds, investing and navigating the current economic situation

Before we get to my visit to Arise TV studio…

US passes bill to ban tiktok

The United States House of Representatives has overwhelmingly passed a bill that could eventually ban the social media platform TikTok in the country, in its latest salvo against both China and big tech.The bill received resoundingly bipartisan support, with vote of 352 to 65 in favour. It now heads to the 100-member Senate, where its prospects are less clear. For his part, President Joe Biden has said he would sign the bill into law if it reached his desk. Read more here

Our thoughts

The Americans are jittery- 170million of their citizens are on Tiktok- so wild. Tiktok is owned by a Chinese company and in this world where data (and the owners of it) run the show, the US is concerned about the Chinese influence over their nation and are doing something about it.

It could be seen as bullying because the whole world could do same with Meta and all its platforms, but given that Chinese govt just passed a law that coerces organizations to support them in intelligence gathering- it does make sense. This bill will need to be passed by the senate before it becomes official and ByteDance (TikTok's owners) will either have to sell their US asset or shut it down.

As they say "After God, fear government"

Nigeria plans Eurobond Issuance after two-year hiatus

Nigeria hired investment banks including Citigroup Inc., JPMorgan Chase & Co. and Goldman Sachs Group Inc. to advise it on the West African nation’s first eurobond issue since 2022, according to people familiar with the deal. The size of the eurobond offer, which is expected before June, has yet to be determined, said the people who asked not to be identified because they’re not authorized to comment publicly on the matter. Africa’s largest oil producer may raise as much as $1 billion in external borrowing this year to meet its spending needs, they said. Read more here

Our thoughts

This is a welcome development that should probably had been done in June 2023. Nigeria is short on USD. There are 3 ways to fix it:

1. Start exporting, stop importing (this will take a while)

2. Sell assets like NNPC, power license etc (A little dicey... could go to the wrong hands)

3. Borrow (easiest and probably only short term option)

Why Borrow?

Current inflation has been driven by Exchange rate and energy costs (which are also driven by exchange rates). In simple English, exchange rate drives the sanity or madness in the economy! So to provide stability, stabilise FX while working towards diversifying the economy! The value and money created from the diversified and growing economy will pay back the debt and debt servicing.

We await more information about this offer. Ideally, Nigeria needs more than the $1billion announced. Fingers crossed

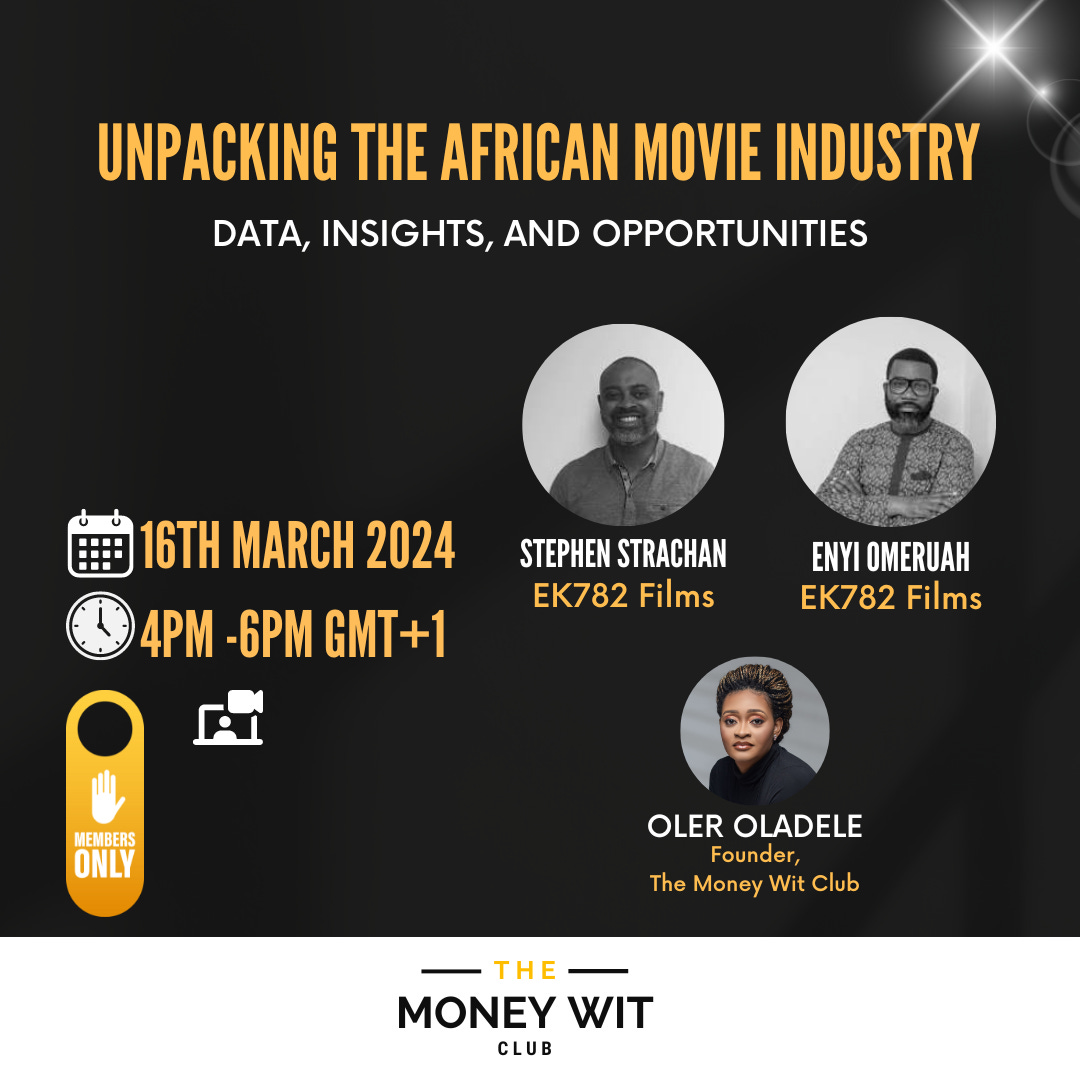

What's happening at The Money Wit Club (TMWC)

We’ve invested in movies, wine and art in the past! Amazon prime announced their exit from Africa earlier this year, this session is to let us know where the money is, who is spending money on movies and what kind of movies they are looking for. #investinthefuture

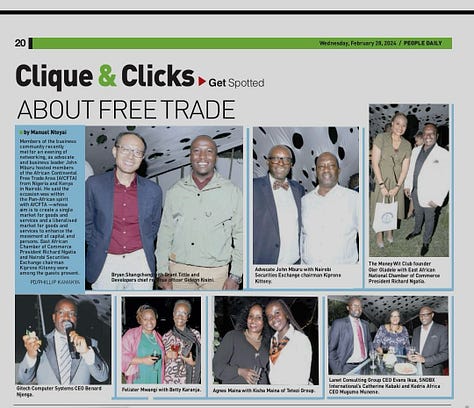

#TMWCINNAIROBI

The Money Wit Club business tour to Nairobi Kenya To be a part of any of these?

Join The Money Wit Club, visit www.themoneywitclub.com

Here's the replay of my interview on AriseTV... we talked about Eurobonds, where to invest right now and how to navigate the current economic situation! Feel free to reply with any questions you have