Global News: U.S economy grew at 2.8%pace in the second quarter, much more than expected

Senate passes Finance Act amendment bill, increases banks' windfall levy to 70%

Economic activity in the U.S. was considerably stronger than expected during the second quarter, boosted by a strong consumer, government spending and a sizeable inventory build, according to an initial estimate Thursday from the Commerce Department.

Our thoughts

GDP (Gross Domestic Product) is a sum of the value of all goods and services produced in a country. US GDP grew by 2.8% between April and June. This was driven by household spending and government spending. The good part is that while the economy is growing, inflation is slowing down making a beautiful path for the much-awaited rate cuts.

How will the rate card affect you?

When USD has lower rates, people are able to borrow more money. With more cash they are able to buy more assets. Increased demand for assets means higher prices which means profit for those that bought before the rate cuts.

See it?

African News: Cameroon Issues $550mln in Eurobonds

Cameroon has raised $550 million in Eurobonds, leveraging a period of lower interest rates and increased demand for African debt. This move follows similar issuances by Côte d'Ivoire, Kenya, Benin, and Senegal.

Our thoughts

7 years at 10.75% is actually quite high, especially for a francophone African country whose currency is tied to the Euro. This is a true reflection of the impact of scarcity of cash in the financial system and the high interest rate global situation.

As an investor, 10.75%in USD terms is a mighty good deal!

Nigerian News: Senate passes Finance Act amendment bill, increases banks' windfall levy to 70%

The Nigerian senate yesterday passed the amendment bill of the 2023 Finance Act and increased the windfall levy on banks’ foreign exchange revaluation gains from 50% as proposed by the President to 70%.

Our thoughts

Last week, we talked about the legal basis for this move! Now we have it- the Finance Act has been amended to include the windfall tax that will be effective between 2023 and 2025

Windfall tax is not new or peculiar to Nigeria, UK government implemented 25% energy profit levy on energy company on the extraordinary profits due to the spike in crude oil prices from pandemic-driven demand and the Ukraine wars. What is unique here is that the banking system was not created by external factor but by the impact of government policy.

The plan is to use the windfall to fund the supplementary budget defect coupled with the current recapitalization drive. Banks sure do have a lot on their plate right now.

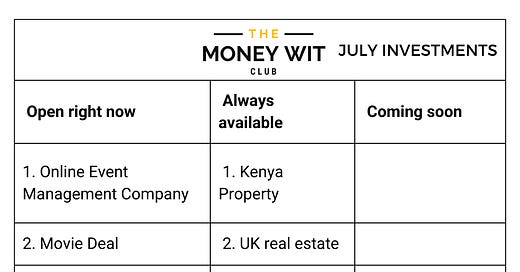

What’s happening at the Money Wit Club…..

Did you enjoy reading this? Help spread the message by forwarding to at least 10 of your contacts.

Was this email forwarded to you? Subscribe here.

We host weekly money discussions live on our YT channel… visit our channel

Want to advertise with us? Email business@oleroladele.com