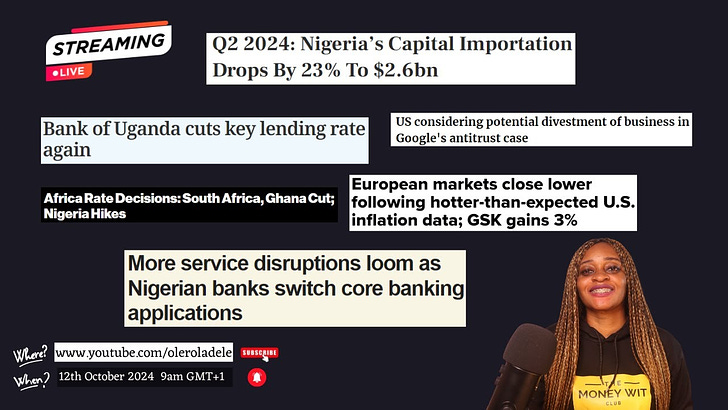

Global News: US considering potential divestment of business in Google's anti-trust case.

Nigeria's Capital Importation Drops by 23% to $2.6bn

The US said on Tuesday it may ask a judge to force Alphabet's Google to divest parts of its business, such as its Chrome browser and Android operating system, that it says are used to maintain an illegal monopoly in online search.

Our thoughts

This will be interesting!

Pulling this off will set a precedence for other big tech breakups.

The US Department of Justice (DOJ) is saying that Google's dominance in the online search engine market is actually monopoly and against the law.

What is interesting are the two options being toyed with:

Break up the company

Or make their data open to all.

Option 1 → Break up

User experience may be impacted by the loss of integration but the spin-offs may unlock some hidden value in some departments.

The company will be forced to choose and stick to what’s core to them.

Cash- A spin-off will bring in extra cash to investors that would most likely be paid out as dividends.

Summary: It's dicey but may not be so bad.

Option 2 → Share their data.

Competition will be mad. The edge Google has over everyone will be broken (or at least impaired significantly).

Generally, AI models will improve because of broader data and Google's Cloud's AI offerings will lose their unique selling point.

AI ethical concerns and biases will be amplified! Scary.

Ad market will be disrupted.

Google will generally loose its dominance and quickly too.

Summary: As a Google stock owner, it sounds like a split-up is a better deal!

Except if Google is able to put a paywall on its data sharing, the outcomes for option 2, the outcomes don’t look great for the company.

Finally, it’s important to note that all the big tech will be affected by a judgment that impacts Google significantly. The only constant thing in life is change.

African News: Africa Rate Decisions- South Africa, Ghana Cut, Nigeria Hikes.

The South Africa Reserve Bank and Bank of Ghana joined the Federal Reserve, Bank of England and Bank of Japan with interest-rate cuts recently. South Africa’s reduction was the first in four years as it signaled a more optimistic outlook for inflation.

Our thoughts

The whole world is in rate-cutting mode: Uganda, South Africa, Ghana, Kenya!

I hope it is clear how cyclical the economies of the world are and how they all tend to align with the same trend. Never forget, it all starts with America (at least for now, till something changes).It’s also important to look out for the outlier economies. Taking rates when everyone is cutting could be seen as a sign of desperation: an extreme need to attract investors. This may become counterproductive as investors thread with added caution.

Nigerian News: Nigeria's Capital Importation Drops by 23% to $2.6bn

Nigeria’s capital importation in the second quarter of 2024 declined by 22.85 percent from $3.37 billion in the first quarter of the year to $2.60 billion, the National Bureau of Statistics (NBS) said in Abuja on Tuesday.

Our thoughts

Why is this important information?

Because it is a clear report card for the activities of the central bank and the coordinating member of finance.

The amounts are a massive decline from previous years when billions of dollars came in monthly.

Portfolio investments- Inflows for stocks and treasury bills and bonds were the largest chunk, reflecting bank recapitalization drive and the attractiveness of the high interest rates.

Foreign direct investments were the least, reflecting how unattractive Nigeria is as an investment destination.

Fact: The attractiveness of a country is fundamental to the amount of capital imported and is directly tied to FX exchange rate stability.

Nigeria has loads of work to do.!

What’s happening at the Money Wit Club…..

Did you enjoy reading this? Help spread the message by forwarding to at least 10 of your contacts.

Was this email forwarded to you? Subscribe here.

We host weekly money discussions live on our YT channel… visit our channel

Want to advertise with us? Email business@oleroladele.com