Global News: Meta Plans launch of new AI language model LLAMA 3 in July

Meta is planning to release the newest version of its artificial-intelligence large language model Llama 3 in July which would give better responses to contentious questions posed by users, The information reported on Wednesday. Meta researchers are trying to "loosen up" the model so that it could at least provide context to a query it deems controversial.

Our thoughts

The artificial intelligence war is raging. Whats your strategy in jumping in on it? You can play on the side of headliners (e.g Meta, Google bard etc) or you can play on the side of the supporting engine that all the headliners are plugging into (eg NVIDIA). Which ever side you prefer, make sure you are investing in the future not the past. AI is the present future, plug into it.

Nigerian News: CBN, FX and the Nigerian Business

CBN jacks up interest rates

The Central Bank of Nigeria, CBN has raised its benchmark interest rate, the Monetary Policy Rate MPR to 22.75 per cent. CBN Governor, Mr. Olayemi Cardoso disclosed this at the end of the Monetary Policy Committee, MPC meeting held in Abuja today. Cardoso said that the asymmetric corridor around the MPR was adjusted to +100 – 700 basis points from + 100 -300 basis points.

“The Cash Reserve Ratio (CRR) was increased from 32.5 per cent to 45 per cent, while the Liquidity Ratio was retained at 30 per cent.gas.

CBN resumes sale of USD to BDCs

In a bid to address the lingering price distortions affecting the Naira’s exchange rate, the Central Bank of Nigeria (CBN) has authorised the sale of $20,000 to eligible Bureaux De Change (BDCs). The decision comes after the bank said it observed continued price distortions at the retail end of the market, which is feeding into the parallel market and further widening the exchange rate premium. Read more here

CBN withdraws license of 4000+ BDCs

The Central Bank of Nigeria (CBN) has revoked the operational licences of 4,173 Bureaux De Change operators in the country. The bank disclosed this Friday through a statement signed by the acting Director, Corporate Communication, Sidi Hakama. The bank said the affected institutions failed to pay for licence renewal, submit returns or comply with CBN directives on anti-money laundering, countering financing of terrorism, and counter proliferation financing regulations. Read more here

MTN Nigeria incurs N740 billion in forex losses, shareholders funds wiped out

MTN Nigeria Plc has reported a loss before tax of N177.8 billion compared to a pre-tax profit of N518.8 billion a year earlier. The losses resulted in a wipe-out of shareholders’ funds. The company attributed the losses to a massive foreign currency loss of N740 billion up from N81 billion reported in 2022. This is the company’s first-ever loss since it became a quoted company in Nigeria.

Our thoughts

The Central Bank of Nigeria is actively fighting for the currency. We unpacked all the jargon in the MPC outcome here. Taking up interest rates will (think should) attract offshore investors and bring some stability to exchange rates.

Let's hope that confidence is restored and Nigerians stop flogging the Naira✌️

On MTN...

revaluation losses crystalize when they are converting to USD to pay dividend to their foreign owners.

For Nigerians in Nigeria, invested in Naira and receiving dividend in Naira, revaluation losses are paper losses.

MTN will also use those losses to reduce tax burden for years.

As long as the company is still profitable (and growing) in Naira. As a Naira investor, its still a buy.

The loss declared was on N900/$ exchange rate, we are now at N1,500/$ 😒

The markets are going to sell hard- especially Pension fund Administrators (PFAs) that have clear guidelines to only buy stocks that have paid dividend for 3 consecutive years.

This is one of the very clear 'buy the dip and give it time" shares

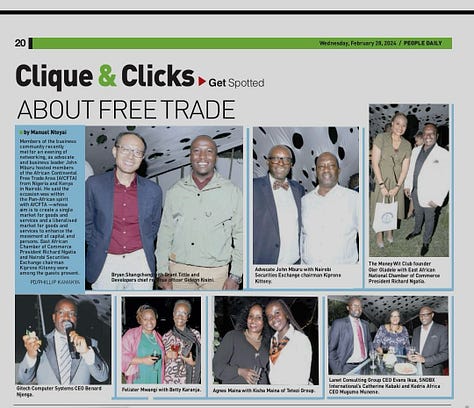

What's happening at The Money Wit Club (TMWC)

#Newinvestmentopportunity

#TMWCINNAIROBI

The Money Wit Club business tour to Nairobi Kenya To be a part of any of these?

To join The Money Wit Club, visit www.themoneywitclub.com