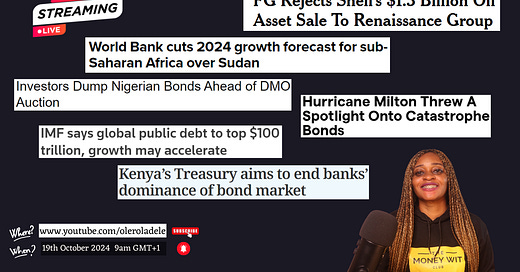

Global News: Hurricane Milton Threw A Spotlight Onto Catastrophe Bonds.

FG rejects Shell’s $1.3 billion oil asset sale to Renaissance Group

Catastrophe bonds (cat bonds) transfer disaster risk from insurers to investors, offering high yields and portfolio diversification. They hedge against market volatility but carry event, liquidity, and counterparty risks.

Our thoughts

How life affects markets. To hedge (or minimize) the impact of payouts for natural disasters on their financials, the insurance industry created a high-yield bond that will pay them (i.e., insurance coy) when a natural disaster is of a predefined magnitude.

How does it work?

The insurance company will issue a bond at a high rate (think 5-8%) for a fixed term, and investors will buy. The high yield is offered in exchange for a caveat or an option- (example of an option: If a magnitude 7earthquake occurs and my payouts exceed $100m dollars, I will use your principal investment to pay the excess and you walk away with nothing!

Wild right?

But investors have bought into it and Hurricane Milton is about to create a case study on the risk of a CAT bond crystallizing.

Why would investors buy this bond?

1. The "high" yield was attractive

2. Fortune favors the brave.

3. It is a rare event- Hurricane Milton was the worst hurricane in 100years.

For the Insurance company for paying 6.5%, his was a really good deal- I guess that's what Insurance is about

African News: World Bank cuts 2024 growth forecast for sub-Saharan Africa over Sudan.

The World Bank said on Monday it had lowered its economic growth forecast for sub-Saharan Africa this year to 3% from 3.4%, mainly due to the destruction of Sudan's economy in a civil war

Our thoughts

World Bank Cuts growth forecasts. I’m sure you wonder the point of these forecasts especially when they can suddenly show up and "rerise" it lol. But these reports are written by PHDs and Professors in economics that have crunched data, examined trends and come up with forecasts.

Why do they matter?

It’s a World Bank report — everyone listens to World Bank, so you need to listen to what "everyone is listening to".

On the back of 1, think of World Bank as an influencer If they are spotlighting countries as growth drivers in the region, and I am looking to invest in SSA, where do you think I'd pitch my tent?

These reports give a sense of the general direction. Last year’s forecast was 2.4%, and next year's forecast is 3.9% growth. The trend? Growth & economic expansion is expected. What do you do with this? Find the countries & sectors that are expected to drive this growth and get a piece of the pie!

What if the trend was of a contraction?

Look out for sectors countries that would be impacted most and jump-ship or find defensive sectors/countries and hug them tight.

These reports are usually a long read, but summary findings, or articles summarizing them are usually enough to provide some guidance. Open your mind.

Nigerian News: Nigerian News: FG rejects Shell’s $1.3 billion oil asset sale to Renaissance Group

The Federal Government, through the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), has rejected the proposed $1.3 billion sale of onshore oilfields to the Renaissance Group, citing the buyer’s lack of qualification to manage the assets, according to a Reuters report.

Our thoughts

As they say, “after God is government”. There are laws guiding every industry, and it’s important to recognize the understand them and the possible bottlenecks they may hold.

Whilst Shell has a "right" to exit any jurisdiction due to business reasons, the sector is HIGHLY regulated, and any sale announcement would definitely attract intense scrutiny.

For the Renaissance consortium, Is this the end? We’ll have to wait and see. They would need to get all the past issues raised (they are many) and represent with a great deal of lobbying.

But let's process the loss in time, effort, and financial resources that the consortium would have incurred. Lawyers, Investment bankers, Consultants will collect their fee which may have a fixed element and a problem based on success of the deal. #insidelife

For Shell — they are “stuck” till they find a buyer that passes the regulatory hurdle.

For Nigeria’s economy → the staff that would have been let go, the businesses that feed from them, they can sleep easy — at least for now.

What’s happening at the Money Wit Club…..

Did you enjoy reading this? Help spread the message by forwarding to at least 10 of your contacts.

Was this email forwarded to you? Subscribe here.

We host weekly money discussions live on our YT channel… visit our channel

Want to advertise with us? Email business@oleroladele.com